There Is A Better Way to Do This

Roger Stube first learned of Children’s Literacy Initiative when his daughter, Kristina, joined the organization. Having worked for several years in a school district, Roger felt his own personal connection to CLI’s mission—one that he describes as necessary. “Kids need to be able to read to be successful,” shares Roger as he reflects on his donor experience at CLI.

Around the same time that Roger started making contributions to CLI, the US Congress had recently made permanent a law allowing individuals over age 70½ to make tax-free donations to qualified charities, such as CLI, directly from their individual retirement accounts (IRA). The IRA charitable rollover or, as it is also known, a qualified charitable distribution (QCD), can help satisfy an individual’s required minimum distribution (RMD) for the year, and because the funds go directly to charity, are not considered taxable income.

Roger explored how this gift option could provide him a better way to effectively give while maximizing the impact of his contributions among his favorite charities, including CLI. He states, “I knew there had to be a better way to do this."

For over half a decade, Roger has included QCDs in both his tax planning and charitable giving strategy. “The greatest benefit for me,” he shares, “is making that significant annual gift that will make impact.”

The beginning age for RMDs now is 72, but QCDs still can begin at 70½. Speak with your professional tax advisor for additional information on your particular situation.

The information provided in this material is presented solely as general educational information and is not intended to be a substitute for tax, legal or accounting advice. You should consult your own tax, legal, accounting and/or financial advisors for advice specific to your situation.

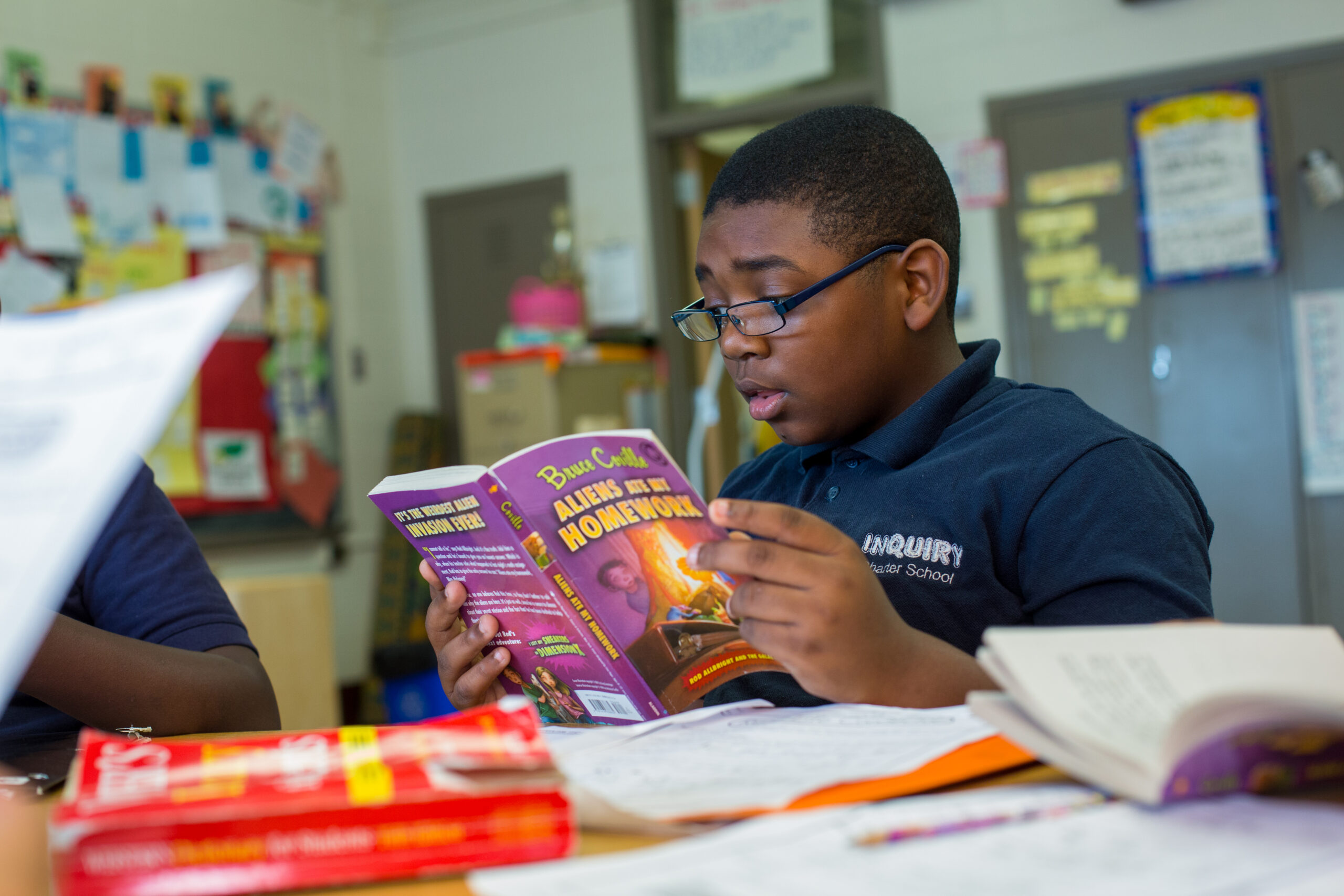

Transforming Research into Practice

For over 30 years, CLI has demonstrated expertise in translating best-in-class early literacy and pedagogy research into effective teacher practice in classrooms. We have drawn upon this competency to create an enriched early literacy instructional model informed by the latest research that exists at the intersections of literacy, racial equity, and anti-racist pedagogical best practice.

Maximize Impact Through Smarter Giving

Appreciated securities that you have owned for more than one year make excellent charitable gifts! A number of donors maximize their charitable giving and impact by donating publicly traded stocks, bonds or mutual fund shares to CLI. It’s one of the easiest and most tax-smart ways to give more to a cause you care deeply about. And, it offers you a number of financial benefits:

- You bypass capital gains tax;

- You may receive a charitable income tax deduction, if you itemize your deductions.

- The full value of the securities goes directly to amplifying reading outcomes for Black and Latinx children.

Contact us for transmittal instructions if you wish to make a gift to CLI in the form of appreciated securities.

CLI is Sharpening Its Focus

Children’s Literacy Initiative seeks to dismantle structural racism by providing Black and Latinx children with the anti-racist early literacy instruction, support, and advocacy needed to create equity in education.

Sample Language for Your Will

To include CLI in your will, you may wish to share the following language with your estate-planning attorney:

I give, devise and bequeath to Children’s Literacy Initiative (tax identification number 23-2515768), (insert a sum, percentage, specific property, or residue/remainder) of my estate.

For more information about CLI’s Legacy Society and how you can shape your legacy with Children’s Literacy Initiative, please contact Simone Champagnie at schampagnie@cli.org.